Tate & Lyle PLC 2020 Full Year Results Statement

Key highlights

- Year of strong performance

- Food & Beverage Solutions delivered strong revenue and double-digit profit3 growth

- Sucralose profit3 slightly ahead

- Primary Products profit3 higher despite challenging market conditions

- Priorities to ‘Sharpen, Accelerate and Simplify’ underpinning performance

- Productivity programme increased from US$100m over 4 years to US$150m over 6 years

- Strong balance sheet and access to over US$1billion in available liquidity

- New commitments for living our Purpose including ambitious sustainability targets

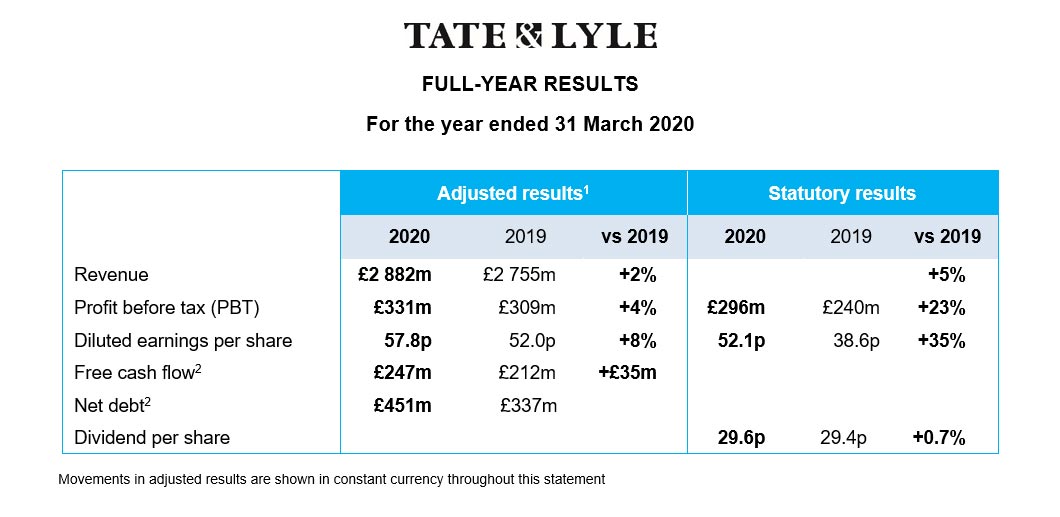

Financial highlights

- +10% increase in Food & Beverage Solutions profit3 to £162m; +1% volume; +5% revenue

- +1% increase in Sucralose profit3 to £63m

- +3% increase in Primary Products profit3 to £158m with Sweeteners & Starches +1%, Commodities +17%

- +23% increase in Group statutory profit before tax due to lower exceptional costs

- +4% increase in adjusted profit before tax

- +8% increase in adjusted diluted EPS benefitting from lower effective tax rate of 17.9% (2019: 21.0%)

- +£35m higher adjusted free cash flow at £247m; Net debt / EBITDA ratio 0.9x

- +40bps improvement in return on capital employed to 17.5%

- Final dividend unchanged at 20.8p, making a full-year dividend of 29.6p, up 0.7%

Covid-19 and trading in April 2020

- Measures in place to protect employees, keep operations running and serve customers

- Actions taken in March to reduce costs, preserve cash and maintain financial strength

- Food & Beverage Solutions volume in line with comparative period; Sucralose volume 18% higher

- Primary Products bulk sweetener volume 26% lower; industrial starch volume 9% lower

Nick Hampton, Chief Executive, said:

“This has been another year of consistent delivery. We made good progress executing our strategy with strong revenue and profit growth from Food & Beverage Solutions and profit growth from Primary Products in more challenging markets.

Food & Beverage Solutions delivered revenue growth in each region with revenue from New Products 15% higher. Operational execution was excellent and our three priorities to ‘Sharpen, Accelerate and Simplify’ the business continued to support performance. Customer focus was sharper, our innovation delivered strong growth and we delivered productivity ahead of target. Our culture is enabling us to move with greater pace and agility and we entered the new financial year with real momentum.

Our purpose of Improving Lives for Generations drives what we do and today we are announcing ambitious new commitments to help support healthy living, build thriving communities and care for our planet.

I am very proud of the way we have responded to the unprecedented challenges of Covid-19. Our purpose has been at the heart of our response, ensuring we care for our colleagues, their families and local communities as well as playing our part in supporting the food supply chain. Throughout the pandemic, we have continued to work very closely with our customers and support them as they have adapted to a rapidly changing operating environment. I want to thank all my colleagues for their extraordinary commitment, courage and agility in the face of Covid-19, and for truly living our purpose during these most difficult of times.

At the start of our 2021 financial year, with lockdowns in the US and Europe, trading in April was mixed. Food & Beverage Solutions performed well in the month but reduced out-of-home consumption in the US significantly impacted Primary Products. As the length and extent of the pandemic remains uncertain, we are not issuing guidance for the year ending 31 March 2021. To keep all stakeholders informed of our progress during these uncertain times, we will issue an exceptional first quarter trading update on 23 July 2020.

In the year ahead our priorities are clear – to look after our people and communities, strengthen our relationships with customers, continue to progress our strategy and maintain our financial strength.

Tate & Lyle is a resilient business that meets challenges head-on. The fundamentals of our business remain sound despite the challenges of Covid-19. Our high-quality portfolio of ingredients and solutions enable consumers to enjoy healthier and tastier food products and drinks. Demand for these products is growing and this trend is here to stay. Combined with our financial strength, this gives me confidence we will navigate this period successfully and that our future prospects remain strong.”

1 The adjusted results for the year ended 31 March 2020 have been adjusted to exclude exceptional items, amortisation of acquired intangible assets and the tax on those adjustments. A reconciliation of statutory and adjusted information is included in Note 3 to the Financial Information. Growth percentages are calculated on unrounded numbers. Changes in adjusted performance metrics are in constant currency.

2 IFRS 16 Leases adoption increased net debt by £162 million at 31 March 2020 and adjusted free cash flow by £34 million. Comparatives have not been restated.

3 Adjusted operating profit

About Tate & Lyle:

Tate & Lyle is a global provider of solutions and ingredients for food, beverage and industrial markets.

Tate & Lyle operates through two global divisions, Food & Beverage Solutions and Primary Products, supported by the Innovation and Commercial Development and Global Operations teams. Food & Beverage Solutions is focused on growth by building leading positions globally in the categories of beverages, dairy, and soups, sauces and dressings. Primary Products is focused on delivering steady earnings and generating cash.

Food & Beverage Solutions consists of: Texturants, including speciality starches; Sweeteners, including low- and no-calorie sweeteners; and a Health and Wellness portfolio comprising mainly speciality fibres; and Stabilisers and Functional Systems, which are bespoke ingredient blends that ensure foods retain their structure.

Primary Products consists of high-volume sweeteners, industrial starches and fermentation products (primarily acidulants). It also sells co-products from the corn milling process as animal nutrition.

Tate & Lyle is listed on the London Stock Exchange under the symbol TATE.L. American Depositary Receipts trade under TATYY. In the year to 31 March 2019, Tate & Lyle sales totalled £2.9 billion. For more information, please visit http://www.tateandlyle.com or follow Tate & Lyle on Twitter or Linkedin.